(Published: March 7, 2024)

(Updated: April 15, 2025)

- Free Template Download

- Key Items to Include on an Expense Sheet

- Why You Should Use Templates

- Why It is Important to Track Expenses

- Join Newsletter

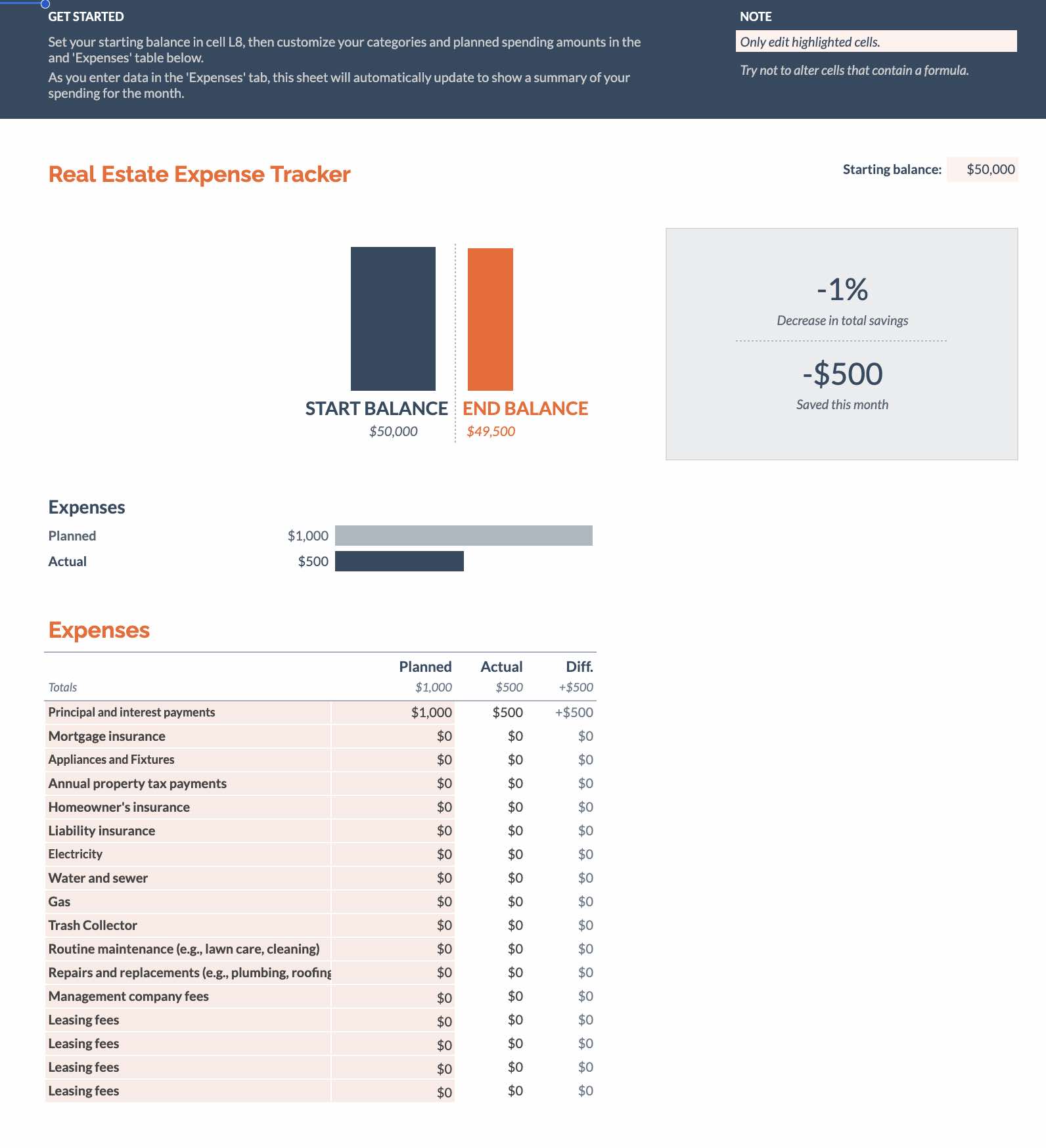

Free Real Estate Expense Tracker Excel Spreadsheet

View File [PDF] | Link To Google Sheets | Download Excel

Connect, share, and grow with like-minded individuals. Don’t miss out on the excitement!

As a third-generation member of a real estate family, I’ve acquired a deep appreciation for the ins and outs of managing a real estate business. One of the most valuable tools I rely on is my real estate expenses spreadsheet, which I’m excited to share with you. This spreadsheet has been instrumental in helping agents like my father and me effectively track, categorize, and manage business expenses.

What makes it even more powerful is aligning its use with the resources provided by the IRS, such as the Tax Guide for Small Business (Publication 334), which outlines which business expenses are deductible and how to track them properly. It’s a good idea to keep up to date on tax expenses throughout your career. This will help you stay organized and find potential tax deductible expenses that can improve financial efficiency. Keep a clear record of professional fees, operational costs, and common expense categories. My spreadsheet can help you keep smarter financial planning and decision-making. It’ll save you time on expense tracking. Combining this tool with resources like the IRS guide ensures we’re maximizing deductions while building a solid foundation for financial success in real estate.

Several sites offer free templates for real estate expenses spreadsheets. For example, Joe Stephenson provides a variety of free top real estate expense spreadsheets You can also find free spreadsheet templates on Google Sheets that are customizable and easy to use.

- Google Sheets has customizable free spreadsheet templates.

- Many other sites offer free or affordable spreadsheet templates.

- A real estate agent expenses spreadsheet is an essential tool for managing your real estate business finances.

I love using an easy to ready and scan expense tracker spreadsheet. It allows me and other real estate agents to efficiently track income and total expenses, providing a clear view of financial performance. I like using them for mostly analyzing spending patterns, and this helps me make informed decisions and save time on financial management, leading to better overall efficiency.

Some Example Inputs on the Real Estate Agent Expenses Spreadsheets

There are several examples of real estate agent expenses spreadsheets available online.

Key Items to Include on a Real Estate Agent Expenses Spreadsheet

- Your Advertising and Marketing Costs – You should include expenses for online listings, print ads, social media promotion, and other marketing materials.

- The Real Estate Agent Commission Calculations and Referral Fees – Try to keep track of payments to other agents and fees paid for referrals.

- Any Education and Training Expenses – Make sure to include costs associated with continuing education, real estate courses, seminars, and workshops.

- Monthly Travel and Vehicle Expenses – Take account for mileage, fuel, maintenance, and other travel-related expenses.

- Your Office Supplies and Equipment – Make sure to list costs for office supplies, computers, software subscriptions, and other equipment.

- Any Insurance Premiums – Make sure to document payments for professional liability insurance, health insurance, and other types.

- All Association Fees: Try to organize and track fees paid to local, state, or national real estate associations.

- Qualified Telecommunication Expenses – Be sure you include mobile phone, internet, and other communication-related expenses.

- Any Home Office Deductions: If applicable, note home office expenses such as a portion of rent, utilities, and internet used for business purposes.

- Your Legal and Professional Services – You should keep records of expenses for legal advice, accounting, and other professional services.

- All Client Entertainment and Gifts – You can list costs related to entertaining clients or purchasing gifts for them within the tax-deductible limit.

- Any Property Management Fees – For REALTORS® managing properties, include fees or charges related to this service.

- All Repairs and Maintenance for Property Listings – Track spending on repairs, maintenance, or home staging for your listings.

- The Utilities for Listings – If paying for utilities at a property you’re selling or leasing, include those expenses here.

- Real Estate Specific Software – Include costs related to customer relationship management (CRM) platforms and other industry-specific software.

Common Tax Deductions

If you don’t already, you should know that claiming tax deductions is a common part of managing your finances as a real estate professional. You’ll find that these deductions can help lower your taxable income and save you money on your overall taxes. Here are what I find are the common tax deductions that real estate professionals should be aware. These are just informational items from me, and should not be considered tax advice or anything. Always double check with a licensed tax professional on this stuff.

| Common Tax Deductions | Explanation |

| Any Related Vehicle Expenses | Real estate agents can claim tax deductions for travel expenses related to real estate transactions, enhancing financial management and cost savings. |

| Your Office Supplies | Expenses related to office supplies are common tax deductions, aiding in expense management and financial planning for real estate professionals. |

| All Related Marketing Costs | Marketing costs are deductible operating expenses, crucial for real estate brokerage and investment, supporting informed business decisions. |

| The Professional Fees | Fees paid to tax professionals for tax filing and financial analysis are deductible, assisting in financial tracking and expense report preparation. |

| Qualified Property Taxes | Real estate agents can deduct property taxes as part of their financial records, contributing to effective real estate operations. |

| Any Related Education and Training | Costs for education and training in real estate are deductible, supporting financial reports and enhancing real estate professionals’ skills. |

| Your Insurance Premiums | Insurance premiums are deductible, aiding in financial analysis and providing cost savings for real estate investment. |

Why Use a Real Estate Agent Expenses Spreadsheet

In the real estate business, making sure you track income and expenses are considered best practices. You’ll want to make sure your business is financially healthy. Any real estate agent expenses spreadsheet should be built in a way that aids real estate agents to efficiently tracking income, expenses, and cash flow. This free resource should help you identify major expenses, manage your budget, and streamline your spending.

What to Include in Your Real Estate Agent Expenses Spreadsheet

Your real estate agent expenses spreadsheet should be very helpful and easy to use. This can include categories for all business-related expenses such as advertising costs, insurance premiums, home office expenses, and other operating expenses.

I think it should also have a section for tracking rental income and other revenue streams. It’s also beneficial to include sections for tracking unreimbursable expenses and tax deductions which are relevant to real estate professionals.

Why it is Important to Track Your Real Estate Agent Income and Operating Expenses

Tracking your real estate income and expenses is a necessary task within the aspect of managing your real estate business. It provides a clear picture of your financial position in the real estate market, which can guide your decision-making process. An expense spreadsheet provides a clear picture of your financial position.

- Categorizing expenses helps with efficient tracking and management.

- Tracking income from rental properties and other sources is vital.

- Accounting software or an income tracker can simplify the tracking process.

- An organized expense sheet aids in efficient tax preparation and filing.

Any REALTOR® expense spreadsheet should make it easy to organize your expenses into different expense categories like rental expenses, additional expenses, and other expenses. It can help you track your rental property income and as well as other real estate agent income. You should consider trying out an income tracker or accounting software; you can easily monitor your money flow and prepare for income tax season more efficiently. An expense sheet is a helpful resource when consulting with a tax professional or filing your tax return, especially if you’re self-employed.

Our Other Real Estate Templates

| Template Name | Description |

|---|---|

Real Estate Agent Expenses Spreadsheet |

Track and manage your expenses efficiently. |

Real Estate Agent Profit and Loss Statement Template |

Analyze your financial performance with ease. |

Real Estate Lead Tracking Excel Spreadsheet |

Keep track of your leads and boost conversions. |

Rental Property Inspection Checklist |

Ensure thorough inspections with this comprehensive checklist. |

Real Estate Agent Daily Schedule |

Organize your day for maximum productivity. |

Real Estate Agent Onboarding Checklist |

Streamline the onboarding process for new agents. |

Real Estate Listing Checklist Template |

Manage your listings effectively with this checklist. |

Rental Property Chart of Accounts Template |

Simplify your accounting with this chart of accounts. |

Rental Property Business Plan Template |

Plan your rental property business strategically. |

Open House Checklist for Real Estate Agents |

Prepare for successful open houses with this checklist. |

Short-Term Rental Management Agreement |

Manage short-term rentals with a clear agreement. |

SWOT Analysis Real Estate Template |

Conduct a SWOT analysis for your real estate business. |

Real Estate Flyer Templates for Real Estate Agents |

Create eye-catching flyers to market your properties. |

Check Back for Updates

We’re excited to announce that we’ve just updated our real estate agent expense tracking spreadsheet to make it even more user-friendly and effective. If you’re using the real estate expense tracker, I think you’ll find that these updates and enhancements helpful. They are made to make it easier to manage the experience of tracking qualified expenses and business expenses very simple. With our latest updates, you’ll find optimized inputs for logging financial data, improving accuracy in preparing tax deduction worksheets, and helping you better prepare for quarterly estimated tax payments.

I’m open to hearing your feedback. Our team is looking for new ways to improve. I want to continually grow our resources, such as the real estate agent income and expense worksheet and the free real estate agent expense tracking spreadsheet, stay useful and up-to-date. These tools not only enable better management of operational costs but also assist in lowering your tax burden by uncovering potential deductions and maintaining clarity on your gross income.

For those working with a qualified tax professional, our updated templates, such as the real estate agent expense report template and real estate agent expense excel spreadsheet, make collaboration with experts seamless. I hope you’ll continue to check back often as we continue to refine tools like the real estate agent expenses spreadsheet to help you achieve greater financial success.

Follow for More Advice for Real Estate Agents and Your Real Estate Business

Consider joining our network and following our website for more advice. I want to be a place where we can share our ideas and best practices. Your professional real estate knowledge is highly valuable and desired here. If you’ve been in the real estate business for a while, you know how many different topics there are to know and become an expert. I guess that’s why I like it so much. There are so many different direction you can take it.

Join Our Real Estate Professional Network

Join us and grow your real estate career in 2025. Gain the tools you need to master tax filing, uncover valuable tax deductions, and identify tax-deductible expenses that can transform your financial outlook. Optimize your business operations and effectively manage finances with a detailed expense report and a comprehensive REALTOR® expense spreadsheet designed to keep you on track every month.

Stay ahead by streamlining business operations, monitoring monthly expenses, and uncovering potential tax deductions that can lighten your tax burden. If you’re managing properties, handling property taxes, or tracking travel expenses, then these tools will help you maintain clarity and precision in your financial records. Simplify your tax return process while creating the foundation for growth and success in the real estate industry.

Join our Real Estate Agent network today, subscribe to our newsletter, and check back regularly for updates. We’ll help make 2025 one of your most successful year for real estate listings yet.