Jump to Section

I love tracking numbers. One of these I’ll have to show my audience how I organize receipts. Until then, here is my easy-to-use lease accounting excel spreadsheet template to provide an example of how it looks and operates. You can download it and customize it for free if you’d like. This template simplifies lease accounting for agents, property managers, and others in the real estate industry, providing clarity and structure where it’s needed most. Having the right tools to track compliance with new lease accounting standards is crucial, especially when working with complex agreements or multiple properties.

This template helps calculate key metrics such as lease amortization calculated over a term and organizes how operating leases are amortized. It also enables you to amortize lease commissions, ensuring even the smallest leasing details are accounted for. Planning ahead becomes easier with its features for managing projected payments and executing different amortization calculations tailored to specific financial needs.

With this template, you can align making periodic payments with financial goals, while factoring in the annual discount rate to ensure accurate calculations. Designed for detailed tracking, it provides a structured monthly basis to outline cash flows, assess total debt, and maintain precise records. Having a reliable system to meet lease accounting standards is critical in this industry. This tool is a practical solution that helps professionals stay organized and proactive.

Free Real Estate Lease Excel Spreadsheet

Excel | Google Sheets

Key Points According to the Federal Accounting Standards Advisory Board (FASAB)

Lease Liabilities and Assets

Lessees must report lease liabilities under “other liabilities” and right-of-use (ROU) lease assets under “property, plant, and equipment” (PP&E).

- Disclosures should include the funded and unfunded portions of lease liabilities.

Disclosures for Lessees

General description of leasing arrangements, including terms for variable lease payments.

- Total lease assets and accumulated amortization, disclosed separately from other PP&E.

- Principal and interest requirements for lease liabilities, broken down by year for the next five years and in five-year increments thereafter.

- Annual lease expense and discount rates used to calculate lease liabilities.

Capitalization Thresholds

Entities must disclose capitalization thresholds for lease assets. These thresholds vary widely (e.g., $25,000 to $1,000,000).

Variable Lease Payments

Variable payments not included in the lease liability are generally immaterial or not applicable for most entities.

Audit and Reporting

Consistent reporting and disclosure practices are critical for transparency.

- Entities must disclose the impact of lease accounting changes on financial statements.

Real Estate-Specific Notes

Real estate leases often include office spaces, land, and residential properties.

- Some entities, like the Department of State, provide additional context by separating domestic and overseas lease disclosures.

Included in the Real Estate-Focused Lease Accounting Excel Template

1. General Information

- Lease Name: Identify the lease (e.g., “Main Office Lease”).

- Lessor Name: Name of the landlord or leasing entity.

- Lease Type: Operating or finance lease.

- Lease Start Date: Date the lease begins.

- Lease End Date: Date the lease ends.

- Lease Term: Total duration of the lease, including renewal options if reasonably certain.

2. Lease Payments

- Monthly Payment: Fixed monthly rent.

- Variable Payments: Any variable components (e.g., based on usage or revenue).

- Total Lease Payments: Sum of all payments over the lease term.

3. Right-of-Use Asset

- Initial ROU Asset Value: Present value of lease payments.

- Accumulated Amortization: Amortization to date.

- Net ROU Asset Value: Remaining value of the ROU asset.

4. Lease Liability

- Initial Lease Liability: Present value of lease payments.

- Principal Payments to Date: Amount of liability paid off.

- Remaining Lease Liability: Outstanding liability.

5. Discount Rate

- Rate Used: Discount rate applied to calculate the present value of lease payments.

6. Disclosures

- General Description: Include terms, conditions, and any significant clauses (e.g., renewal options, termination penalties).

- Variable Lease Payments: Details of variable payments not included in the liability.

- Future Payment Schedule:

- Year 1: Principal and interest.

- Year 2: Principal and interest.

- Years 3-5: Principal and interest.

- Beyond Year 5: Principal and interest.

7. Capitalization Threshold

- Specify the threshold for capitalizing lease assets (e.g., $50,000).

8. Notes

- Include any additional notes, such as changes in lease terms, modifications, or reassessments.

ASC 842 Lease Accounting Template

Instructions

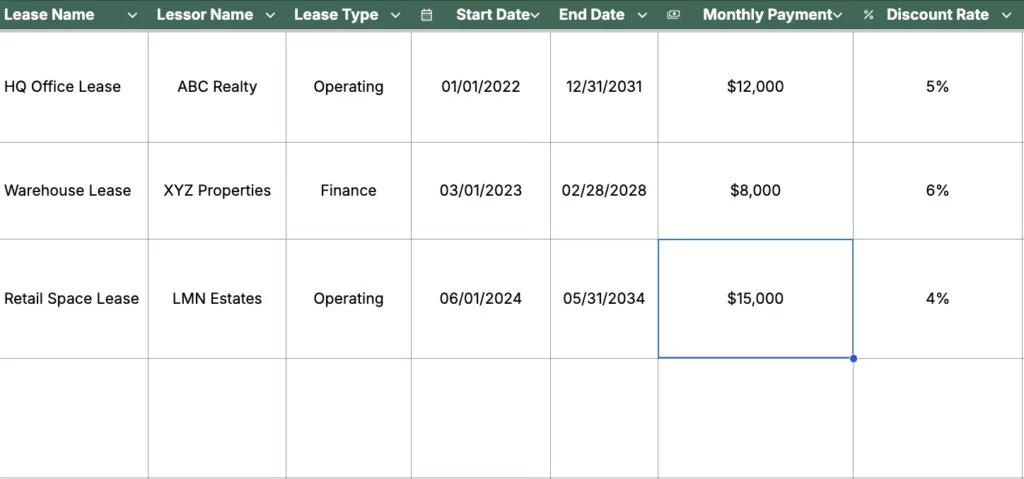

Below is a table where you can input details for each lease. Follow the instructions provided for each column to accurately complete your lease accounting records. Example data for three leases has been included to guide you.

Field Descriptions and Instructions

Lease Name

What to input: Enter the name or identifier for the lease (e.g., HQ Office Lease, Warehouse Lease, etc.).

- Example: “HQ Office Lease”, “Warehouse Lease”.

Lessor Name

What to input: Name of the landlord or entity leasing the property.

- Example: “ABC Realty”, “XYZ Properties”.

Lease Type

What to input: Specify “Operating” or “Finance” based on lease classification under ASC 842.

- Example: “Operating”, “Finance”.

Start Date

What to input: Enter the commencement date of the lease (format MM/DD/YYYY).

- Example: “01/01/2022”.

End Date

What to input: Enter the lease termination or expiration date (format MM/DD/YYYY).

- Example: “12/31/2031”.

Monthly Payment

What to input: Add the flat monthly rent amount excluding variable components.

- Example: “$12,000”.

Discount Rate

What to input: Provide the rate used to calculate the present value of lease payments.

- Example: “5%”, “6%”.

Initial ROU Asset

What to input: Present value of total lease payments at the beginning of the lease.

- Example: “$1,100,000”.

Accumulated Amortization

What to input: Amortization recorded to date on the ROU asset. Calculate proportionally for the lease term elapsed.

- Example: “$240,000”.

Remaining Liability

What to input: Lease liability yet to be paid, including principal.

- Example: “$860,000”.

Variable Payments

What to input: Include expenses such as variable utilities, maintenance fees, or sales-based rent increases that are not part of fixed payments.

- Example: “$500/month utilities”.

Notes

What to input: Add any special terms, such as renewal options, termination clauses, or unusual payment arrangements.

Example: “Includes renewal option for 5 years at adjusted rates”.

Detailed Amortization Schedule for Leases

Example 1). HQ Office Lease

- Lease Name: HQ Office Lease

- Lessor Name: ABC Realty

- Lease Type: Operating

- Start Date: 01/01/2022

- End Date: 12/31/2031

- Monthly Payment: $12,000

- Discount Rate: 5%

- Initial ROU Asset: $1,100,000

- Accumulated Amortization: $240,000

- Variable Payments: $500/month utilities

- Notes: Example instructions below.

Example 2). Warehouse Lease

- Lease Name: Warehouse Lease

- Lessor Name: XYZ Properties

- Lease Type: Finance

- Start Date: 03/01/2023

- End Date: 02/28/2028

- Monthly Payment: $8,000

- Discount Rate: 6%

- Initial ROU Asset: $420,000

- Accumulated Amortization: $80,000

- Variable Payments: None

- Notes: Early termination option.

Example 3). Retail Space Lease

- Lease Name: Retail Space Lease

- Lessor Name: LMN Estates

- Lease Type: Operating

- Start Date: 06/01/2024

- End Date: 05/31/2034

- Monthly Payment: $15,000

- Discount Rate: 4%

- Initial ROU Asset: $1,300,000

- Accumulated Amortization: $50,000

- Variable Payments: Percentage of sales > $1M

- Notes: Variable rent adjustments.

Key Notes

- Interest and Principal Calculations:

- Interest = Beginning Balance × (Discount Rate ÷ 12).

- Principal = Monthly Payment − Interest.

- Structure:

- This format ensures each lease is detailed, with all necessary fields and their associated calculations.

- Customization:

- You can extend the table periods or adjust the payments based on lease-specific terms.

ASC 842 Lease Accounting Template

Disclaimer: This template is provided as an example for educational purposes only. It is not a substitute for professional accounting advice. Users should consult with a qualified accountant or financial advisor to ensure compliance with ASC 842.

You can copy and paste this table directly into Excel, and it will preserve the structure for easy editing and usage.

Important Terms to Familiarize With

1. Lease Amortization Schedule

- Explanation: A table that tracks the reduction in lease liability and right-of-use (ROU) asset over time.

- Application

- Create a schedule detailing payments over the lease term, split between principal and interest.

- Use this to record periodic lease liability reductions and cumulative interest.

- Template Integration

Include columns such as- Monthly Payment

- Interest Expense

- Principal Reduction

- Remaining Lease Liability

2. Operating Lease

- Explanation: A lease where the lessee uses the asset but does not take ownership.

- Application

- Record ROU asset and lease liability on the balance sheet.

- Recognize lease expense on a straight-line basis over the lease term.

- Implementation Tip:

Use the “straight-line lease expense” method to allocate costs evenly across periods.

3. Lease Agreement

- Explanation: The legal contract detailing the terms of the lease (e.g., payment timing, lease period, and lease incentives).

- Template Integration

Include fields for the following- Start Date

- End Date

- Monthly Payment

- Lease Incentives

- Renewal and Termination Clauses

4. Straight-Line Lease Expense

- Explanation: Expense is recognized evenly over the lease term, irrespective of payment timing.

- Application

- Calculate straight-line expense by dividing total lease payments by the lease period.

- Excel Integration

Use a formula such as Total Lease Payments / Lease Period to compute a constant monthly expense.

5. Lease Liability Balance

- Explanation: The present value of future lease payments at the reporting date.

- Application

- Track the liability on the balance sheet.

- Adjust it periodically using payments and interest.

- Example

- Beginning Liability Balance = $600,000

- Payments reduce liability and are split into interest and principal.

6. Lease Incentives

- Explanation: Benefits provided by the lessor (e.g., free rent periods).

- Application

- Reduce total lease expense by incentives, spreading them over the lease term.

- Integration Tip

Factor incentives into net present value (NPV) calculations.

7. Amortization Expense

- Explanation: The expense recognized for ROU asset amortization.

- Application

- Allocate expense over the estimated economic life of the underlying asset.

- Excel Formula

Initial ROU Asset Value / Lease Term

8. Interest Expense

- Explanation: Recognized on the outstanding lease liability balance.

- Application

- Multiply the periodic interest rate by the liability balance for each period.

- Integration into Amortization Schedule

Include a column for interest expense in the “lease amortization schedule.”

9. Initial Direct Costs

- Explanation: Incremental costs directly attributable to negotiating and arranging a lease.

- Application

- Include in the initial valuation of the ROU asset.

- Examples

- Lease commissions

- Legal fees specifically tied to lease negotiation

10. Future Lease Payments

- Explanation: Total expected payments for the lease term.

- Application

- Present future payments in financial statement notes, categorized by year.

- Excel Application

Use formulas to calculate payments for each year.

11. Amortization Calculations

- Explanation: Detailed methods to reduce ROU asset and lease liability over time.

- Suggested Variations

- Straight-line

- Effective interest method (for finance leases)

- Variable lease adjustments

12. Financial Accounting Standards Board (FASB)

- Explanation: The governing body responsible for ASC 842 standards.

- Application

- Ensure compliance with FASB standards for transparency and consistency in lease accounting.

13. Residual Value

- Explanation: The estimated asset value at the end of the lease term.

- Application

- Important for financial/capital leases.

- Consider it for calculating depreciation.

14. Payment Timing

- Explanation: When cash payments occur relative to the reporting period.

- Implementation

- Recognize payment timing differences in journal entries.

15. Financial Leases (Capital Leases)

- Explanation: A lease where ownership transfers or a bargain purchase option exists.

- Application

- Recognize the asset as an intangible asset on the balance sheet.

- Depreciate the asset over the lease period or estimated economic life.

16. Journal Entry

- Explanation

- Capture lease-related transactions.

- Example Journal Entry

- Dr. ROU Asset, Cr. Lease Liability (initial recognition).

- Dr. Lease Expense, Cr. Lease Liability (periodic payment).

17. Amortization Schedule in Excel

- Explanation

- Build an Excel model to track periodic payments, interest expense, and liability reduction.

- Columns

- Beginning Liability Balance

- Monthly Expense

- Interest Rate

- Liability Accretion

- Ending Balance

18. Incremental Borrowing Rate

- Explanation

- Use this rate to discount future lease payments.

- Example

- A company’s borrowing rate adjusted for risk (e.g., 4%).

19. Historical Cost

- Explanation:

- For real estate leases, capture the cost to acquire the ROU asset.

20. Notes and Disclosure

- Requirement

- Provide detailed notes on topics like lease period, net present value of payments, variable payment terms, and future lease payments.

- Template Integration

- Standardize lease agreement disclosures across financial statements.

21. Straight-Line Calculation

- Application

- Standardize recognition of expenses or incentives for consistency and comparability.

Check Back for Updates to this Excel Spreadsheet Template

I am always striving to improve and update this content based on your valuable feedback. My goal is to provide insights and examples, such as an ASC 842 lease accounting example, that are helpful for your financial reporting needs. It’s important to note that this content is for informational purposes only. Accounting laws, especially those focusing on operating leases amortized, initial lease liability, lease agreements, or straight-line lease expense, can vary widely depending on your location. I strongly recommend working with a local accounting expert to ensure compliance with regulations in your state or region.

Check back for updates. As new information becomes available and industry standards evolve, I will continue to revise and enhance this Excel spreadsheet template. My ultimate goal is for this tool to be a valuable resource that saves you time and makes your financial reporting easier.

In the meantime, if you have any questions or suggestions for improvement, please don’t hesitate to reach out to me. We can create a comprehensive and reliable source for all things related to ASC 842 lease accounting.

Joseph E. Stephenson, REALTOR®

License #00054082 | Kansas & Missouri

Affiliated with Welch & Company (License #CO00000477)

Joseph E. Stephenson is a licensed real estate professional in Kansas and Missouri with a career built on dedication to integrity and client-focused service. To learn more about how Joseph can assist you in your real estate endeavors, visit his REALTOR® profile at realtor.com.

Verify Joe’s Real Estate License Credentials

Real Estate Agent License VerificationVerify Joe’s Business Credentials

Joseph E. Stephenson also operates a business named Stephenson Residential, LLC. You can verify the business at the Kansas Secretary of State’s website.

Verify Business Credentials